Credit Payment Processing

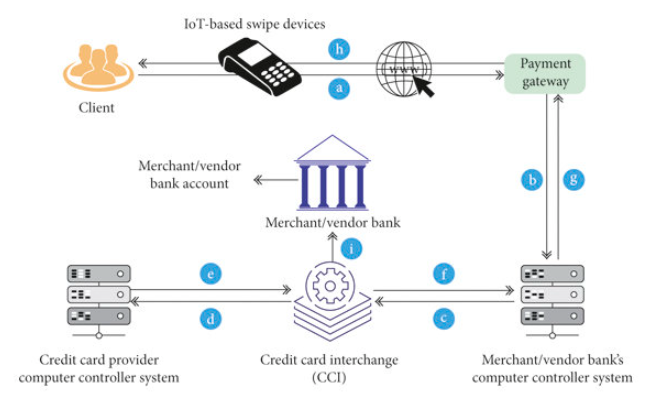

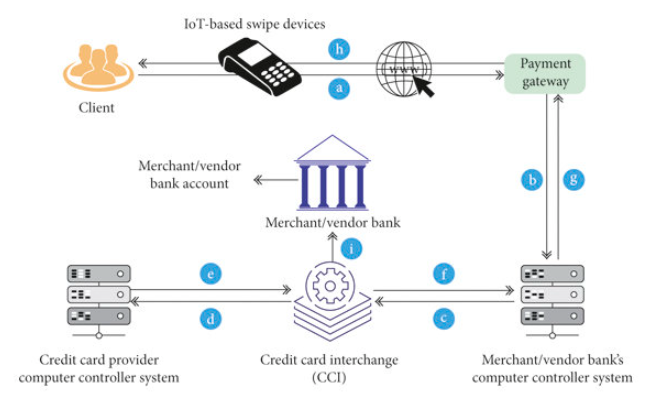

Credit Payment Processing – Credit card payment processing is the series of steps that take place when a customer uses a credit card to make a purchase. The process begins when the customer swipes their card at a point-of-sale (POS) terminal. The POS terminal then sends the customer’s credit card information to the merchant’s acquirer.

The acquirer then sends the information to the credit card network, which verifies the customer’s information and approves or declines the transaction. If the transaction is approved, the credit card network sends the information back to the acquirer, which then sends it to the merchant’s POS terminal. The POS terminal then prints a receipt for the customer.

What is Credit Payment Processing?

The credit card payment processing system is a complex and sophisticated system that involves a number of different players. Each player has a specific role to play in the process, and each role is essential for the process to work smoothly.

Credit payment processing is the system that allows merchants to accept credit card payments. It involves a number of steps, including:

- The customer swipes their credit card at the merchant’s point-of-sale (POS) terminal.

- The POS terminal sends the customer’s credit card information to the merchant’s acquirer.

- The acquirer sends the credit card information to the credit card network.

- The credit card network sends the credit card information to the issuer.

- The issuer approves or declines the transaction.

- The credit card network sends the approval or decline decision back to the merchant’s acquirer.

- The merchant’s acquirer sends the approval or decline decision back to the merchant’s POS terminal.

- The POS terminal prints a receipt for the customer.

The Players in the Credit Card Payment Processing System

The following are the key players in the credit card payment processing system:

- The Cardholder is the person who uses the credit card to make a purchase.

- The Merchant is the business that sells the goods or services to the cardholder.

- The Issuer is the bank or financial institution that issues the credit card to the cardholder.

- The Acquirer is the bank or financial institution that processes the credit card payments for the merchant.

- The Credit Card Network is the organization that operates the credit card payment system.

The Steps in the Credit Card Payment Processing System

The following are the steps involved in the credit card payment processing system:

- The cardholder swipes their credit card at a POS terminal.

- The POS terminal sends the customer’s credit card information to the merchant’s acquirer.

- The acquirer sends the information to the credit card network.

- The credit card network verifies the customer’s information and approves or declines the transaction.

- If the transaction is approved, the credit card network sends a message back to the acquirer.

- The acquirer sends a message to the POS terminal.

- The POS terminal prints a receipt for the customer.

The Benefits of Credit Card Payment Processing

There are a number of benefits to using credit card payment processing, including:

- Convenience: Credit card payments are a convenient way to pay for goods and services. Customers can simply swipe their card and be on their way.

- Security: Credit card payments are a secure way to pay for goods and services. Credit card networks use a variety of security measures to protect customer information.

- Efficiency: Credit card payments are an efficient way to pay for goods and services. Merchants can process credit card payments quickly and easily.

- Acceptance: Credit card payments are widely accepted. Customers can use their credit cards to pay for goods and services at a variety of businesses.

For merchants, credit payment processing can:

- Increase sales: Customers are more likely to buy from merchants who accept credit cards.

- Improve cash flow: Merchants can receive payment for credit card sales immediately.

- Reduce fraud: Credit card payments are more secure than cash or check payments.

For customers, credit payment processing can:

- Provide convenience: Customers can use credit cards to make purchases anywhere that accepts them.

- Earn rewards: Many credit cards offer rewards programs that allow customers to earn points or miles for every dollar they spend.

- Build credit history: Using credit cards and making payments on time can help customers build a strong credit history.

The Challenges of Credit Card Payment Processing

There are a number of challenges associated with credit card payment processing, including:

- Cost: Credit card payment processing can be expensive for merchants. Merchants pay a fee for each credit card transaction they process.

- Fraud: Credit card fraud is a major problem. Merchants can lose money due to credit card fraud.

- Chargebacks: Chargebacks are a type of dispute that can occur when a customer challenges a credit card transaction. Merchants can lose money due to chargebacks.

The Risks of Credit Payment Processing

There are also a number of risks associated with credit payment processing. For merchants, the biggest risk is fraud. Fraudulent credit card transactions can cost merchants money and damage their reputation.

For customers, the biggest risk is identity theft. If a customer’s credit card information is stolen, it can be used to make fraudulent purchases.

How to Reduce the Risks of Credit Payment Processing

There are a number of steps that merchants and customers can take to reduce the risks of credit payment processing. Merchants can:

- Use a secure payment processor.

- Require customers to sign for credit card purchases.

- Keep an eye out for suspicious transactions.

Customers can:

- Keep their credit cards in a safe place.

- Memorize their credit card numbers and PINs.

- Only shop at reputable merchants.

- Review their credit card statements carefully for any unauthorized charges.

The Future of Credit Card Payment Processing

The credit card payment processing system is constantly evolving. New technologies are being developed to make credit card payments more convenient, secure, and efficient.

One of the most promising new technologies in credit card payment processing is contactless payments. Contactless payments allow customers to pay for goods and services by simply waving their credit card over a reader. Contactless payments are faster and more convenient than traditional chip-and-PIN payments.

Another promising new technology in credit card payment processing is mobile payments. Mobile payments allow customers to pay for goods and services using their smartphones. Mobile payments are even more convenient than contactless payments, as customers do not even need to take their credit cards out of their wallets.

The future of credit card payment processing is bright. New technologies are making credit card payments more convenient, secure, and efficient. These new technologies will make it easier and safer for customers to pay for goods and services.