CC Merchant Services

CC Merchant Services – Credit card merchant services provide businesses with the ability to accept credit and debit card payments. These services are essential for any business that wants to sell products or services online or in person.

What are CC Merchant Services?

Credit card merchant services allow businesses to accept credit and debit card payments. These services are provided by merchant service providers, or MSPs. MSPs work with banks and credit card companies to process payments on behalf of businesses.

Credit card merchant services are the tools and processes that allow businesses to accept credit card and debit card payments from their customers. These services are provided by merchant service providers (MSPs) who work behind the scenes with banks and credit card companies to handle the entire transaction flow.

How do CC Merchant Services work?

CC Merchant Services, or Credit Card Merchant Services, work through a series of steps to process your customer’s credit card payment. Here’s a breakdown:

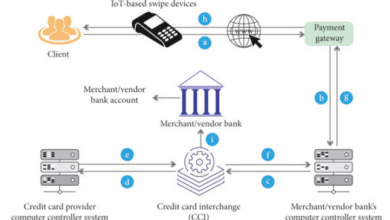

- The Sale: When a customer makes a purchase and chooses to pay by credit card, they swipe their card through a card reader (physical stores) or enter their card information into a virtual terminal (online stores).

- Information Transfer: The card reader or virtual terminal acts as a middleman, securely capturing the customer’s card details (card number, expiration date, etc.). This information is then sent to the merchant service provider (MSP) you signed up with.

- Authorization Request: The MSP doesn’t hold onto the information. Instead, it forwards the data securely to the appropriate payment network (Visa, Mastercard, etc.). The network then routes the authorization request to the issuing bank – the bank that issued the credit card to your customer.

- Authorization Check: The issuing bank receives the request and verifies several things:

- If there are sufficient funds available in the customer’s account.

- If the card is active and not expired or reported lost/stolen.

- Whether additional security checks like CVV code verification are needed to prevent fraud.

- Response: Based on the checks, the issuing bank sends an approval or decline message back to the payment network.

- Funds Transfer (if approved): If approved, the payment network informs the MSP, and the MSP initiates the transfer of funds from the issuing bank to your merchant account at the acquiring bank (the bank that holds your business account). There might be a slight delay (usually 1-3 business days) before the funds appear in your account.

- Confirmation & Receipt: Finally, the MSP sends a confirmation message to your system indicating a successful transaction. You can then provide a receipt to your customer.

Additional Points:

- Merchant service providers charge fees for processing these transactions. These fees can be a combination of per-transaction fees and monthly fees.

- Security is paramount throughout the process. MSPs use various secure protocols to protect sensitive cardholder information.

By using CC Merchant Services, you benefit from faster transactions, increased sales opportunities, and improved customer convenience.

What are the Benefits of using CC Merchant Services?

There are several key benefits to using CC Merchant Services (Credit Card Merchant Services) for your business:

- Increased Sales: Customers are more likely to complete a purchase if they can pay with their preferred credit card. By offering this convenient payment option, you open yourself up to a wider customer base and potentially boost your sales.

- Improved Customer Convenience: The ease and speed of credit card transactions make the checkout process smoother for your customers. This can lead to a more positive customer experience and encourage repeat business.

- Reduced Fraud: Modern credit card systems incorporate various security features like chip cards and PIN verification to help prevent fraudulent transactions. Merchant service providers also utilize fraud detection tools to further minimize risk.

- Better Cash Flow: Unlike checks that can take time to clear, credit card payments are typically deposited into your merchant account within 1-3 business days. This faster access to funds improves your cash flow and financial flexibility.

- Enhanced Business Image: Accepting credit cards projects a professional and modern image for your business. It demonstrates that you’re equipped to handle a variety of payment methods, which can build trust with potential customers.

- Additional Features: Many merchant service providers offer additional features beyond basic credit card processing. These can include online payment options, recurring billing capabilities, mobile payment acceptance, and detailed sales reports.

While these are some of the main advantages, it’s important to consider the potential drawbacks as well.

- Processing Fees: Merchant service providers charge fees for processing transactions. These fees can vary depending on the provider, your business volume, and the type of card used.

- Monthly Fees: Some providers may charge a monthly account maintenance fee on top of per-transaction fees.

- Contractual Obligations: Be mindful of any contractual terms associated with your merchant service agreement. There might be early termination fees or minimum processing volume requirements.

Overall, CC Merchant Services can be a valuable tool for businesses of all sizes. By offering convenient and secure payment options, you can streamline your operations, attract new customers, and improve your overall financial health. Just be sure to weigh the benefits against the costs and choose a merchant service provider that fits your specific needs and budget.

What are the Costs of using CC Merchant Services?

There are a few costs associated with using credit card merchant services, including:

- Processing fees: MSPs charge processing fees for each transaction they process.

- Monthly fees: Some MSPs charge a monthly fee for their services.

- Setup fees: Some MSPs charge a setup fee for new accounts.

How to choose a CC Merchant Services?

When choosing a credit card merchant service provider, it is important to consider the following factors:

- The types of payments you want to accept

- The volume of transactions you process

- Your budget

- The features and services you need

Conclusion

Credit card merchant services can be a valuable asset for businesses of all sizes. By accepting credit cards, businesses can increase their sales, improve customer convenience, reduce fraud, and improve their cash flow. When choosing a credit card merchant service provider, it is important to consider the factors listed above to find the best provider for your needs.