Same Day Credit Card Processing

Same Day Credit Card Processing – Same-day credit card processing allows businesses to receive funds from credit card transactions on the same day they are processed. This can be a major advantage for businesses that need to access cash quickly, such as those that operate in high-volume industries or have seasonal fluctuations in sales.

Same Day Credit Card Processing: Everything You Need to Know

Same day credit card processing is a service that allows businesses to receive funds from credit card transactions on the same day they are processed. This can be a major advantage for businesses that need quick access to cash flow, such as e-commerce businesses or retail stores.

How does Same Day Credit Card Processing work?

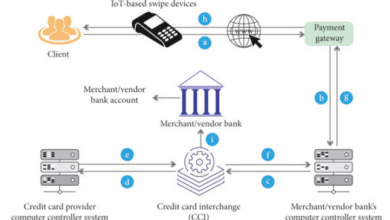

Same-day credit card processing is typically offered by third-party payment processors. These processors act as intermediaries between businesses and credit card companies, facilitating the transfer of funds.

To set up same-day credit card processing, businesses must first open a merchant account with a payment processor. Once the account is open, the business will need to provide the processor with some basic information, such as their business name, tax ID number, and bank account details.

Once the business’s account is set up, they can begin accepting credit card payments. When a customer makes a purchase, the business will submit the transaction to the payment processor. The processor will then route the transaction to the credit card company for authorization.

If the transaction is authorized, the processor will deposit the funds into the business’s bank account on the same day.

Advantages of Same-Day Credit Card Processing

Same-day credit card processing offers a range of benefits for businesses, particularly those needing faster access to funds. Here’s a breakdown of the key advantages:

- Swifter Cash Flow: This is the most significant perk. Traditional processing can take 2-5 business days for funds to settle in your account. Same-day processing gets you the money on the same business day, improving your cash flow and financial flexibility.

- Enhanced Operational Efficiency: Faster access to funds allows you to manage your business expenses and payroll more effectively. This can improve your overall financial health and ability to seize time-sensitive opportunities.

- Reduced Costs: Holding onto funds for several days can lead to additional fees or the need for short-term loans. Same-day processing eliminates these costs, potentially saving you money in the long run.

- Potential Sales Boost: Offering a wider range of payment options can attract customers who prefer the convenience of credit cards. Faster processing ensures a smoother checkout experience, potentially leading to increased sales.

Additional Considerations:

While same-day processing offers clear advantages, it’s important to weigh them against potential drawbacks:

- Higher Fees: Compared to traditional processing, same-day options often come with steeper fees. Carefully evaluate the cost-benefit analysis to ensure it aligns with your business needs.

- Eligibility Requirements: Not all businesses qualify for same-day processing. Factors like industry, transaction volume, and credit history may play a role.

- Technical Aspects: Setting up and managing same-day processing might involve additional technical considerations compared to traditional methods.

By understanding both the benefits and drawbacks, you can make an informed decision on whether same-day credit card processing is the right fit for your business.

Downsides of Same-Day Credit Card Processing

While same-day credit card processing boasts attractive benefits, there are also some drawbacks to consider before you jump in. Here’s a closer look at the potential challenges:

- Higher Fees: Be prepared for steeper costs compared to traditional processing. Same-day services often come with higher per-transaction fees or monthly charges. Carefully evaluate the additional expense to ensure it doesn’t outweigh the advantages for your business model.

- Eligibility Requirements: Not all businesses qualify for same-day processing. Factors like your industry, transaction volume, and credit history can determine eligibility. Businesses with high-risk transactions or a history of chargebacks may be denied.

- Technical Hurdles: Setting up and managing same-day processing might involve additional technical considerations. You may need to integrate with new software or payment gateways, which could require some IT expertise or additional costs.

- Potential Security Concerns: Since same-day processing involves faster transfers, there might be a slightly increased risk of fraud. Implementing robust security measures becomes even more critical to protect your business and customer information.

Making an Informed Decision:

These drawbacks shouldn’t necessarily deter you from same-day processing, but they should be part of your decision-making process. Here’s what to consider:

- Compare Costs: Get quotes from different processors and compare the fees associated with same-day processing versus traditional methods. Ensure the additional cost aligns with the expected benefits for your business.

- Review Eligibility Requirements: Check with potential processors to understand their eligibility criteria. If your industry or transaction volume falls outside their parameters, you might need to explore alternative solutions.

- Evaluate Technical Needs: Assess your current technical capabilities and any potential need for additional software or expertise to manage same-day processing effectively.

- Prioritize Security: Implement robust security measures to mitigate any potential increase in fraud risk associated with faster transactions.

By carefully weighing the benefits and drawbacks, and considering your specific business circumstances, you can make an informed decision about whether same-day credit card processing is the right path forward for your financial success.

Is same-day credit card processing right for your business?

Whether or not same-day credit card processing is right for your business depends on your individual needs and circumstances. If you need to access cash quickly, improve your cash flow, or reduce costs, then same-day credit card processing may be a good option for you. However, if you are on a tight budget or have a low-volume business, then traditional credit card processing may be a better fit.

If you are considering same-day credit card processing, be sure to compare rates and fees from different processors to find the best deal. You should also make sure that you understand the terms and conditions of the processing agreement before you sign up.

Conclusion

In conclusion, same-day credit card processing offers a compelling solution for businesses seeking faster access to funds and improved cash flow. The benefits of quicker settlements, smoother operations, and potential sales growth can be significant.

However, it’s crucial to weigh these advantages against potentially higher fees, eligibility requirements, and any technical complexities. By carefully considering your specific business needs and financial situation, you can determine if same-day processing is the right path to take for a more efficient and potentially more profitable future.